The Story

Your credit card statement probably gives you all kinds of feelings. Like confusion.

You get me.

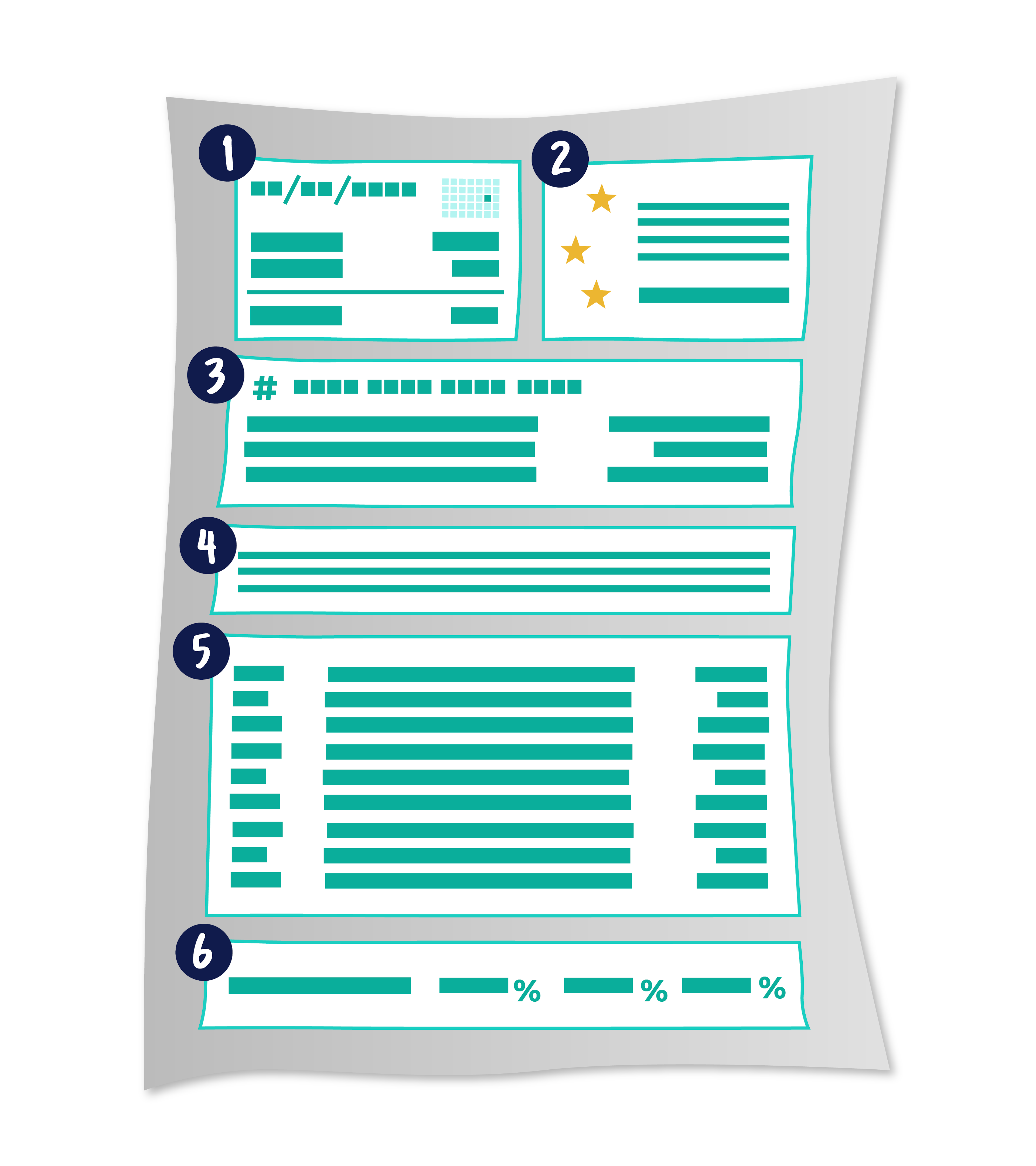

New balance, minimum payment due, interest charged...all credit card statements have the same stats. We’re breaking it down below, so you’ll actually know what to do with that info. Even if your statement looks a liiittle different.

1. Payment Info

New Balance: who dis? (Sorry.) This is the amount you owe for the latest billing cycle. Also answers to: Statement Balance. Hand over the full amount every month, and you won’t pay any interest.

Minimum Payment Due: the least you can get away with paying. It might be a set amount or a percentage of your balance.

Minimum Payment Due Date: you got this one. Miss the deadline, and you’ll get in trouble. Make a calendar reminder or set up auto-payments so you won't be late.

Warnings: a promise, not a threat, about what happens if you don’t pay on time. Think: late fees. And maybe a penalty interest rate for repeat offenders. Pro tip: if you forgot to make your payment...and that’s not usually your style...call your credit card company and ask them to do you a favor and waive the fee just this once.

2. Rewards Summary

The fun stuff. If you have a rewards card, this is where you can see your cash-back, points, or miles balance from this cycle. And the amount you’ve saved over time.

3. Account Summary

A rundown of everything that goes into your new balance: starting with last month’s balance - payments or credits + new charges, fees, and interest. Boom. New balance. This section also usually includes the dates of your payment cycle, your total credit limit, and how much of that limit is still available.

4. Account Messages

The one with all the fine print. Think: disclosures and other important info your bank’s lawyers want you to know. You don’t need to read this every month, but it’s a good idea to know the policies on things like how they deal with mistakes.

5. Account Activity

Sometimes called Transaction History. This is the long part that lists everything you bought recently. Plus background deets, like when, where, and how much you spent. Also any payments and credits. Check this out every month to make sure it’s accurate. If you see something (wrong), say something.

6. Fees & Interest Charges

Includes your current interest rate, interest charges added to your balance this month, and the running total of fees and interest you’ve paid this year. Which could be a lot. Because compounding interest. Even if it feels wrong, make sure everything looks right.

Related: How to Get a Lower Interest Rate on Your Credit Card

theSkimm

Like an Aquarius at a poker table, credit card bills are hard to read. But knowing what you’re looking at and what it means can help you take better control of your money. So you can use it for fun things like virtual concerts and road trips instead of interest and fees.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.