Hey there.

theSkimm is officially 9 years old, and we've been celebrating all week. (Psst...it's not too late to catch the last of our 24-hour birthday bash sales.) But wait, there's more. National Ice Cream Day is this weekend. So look to scoop up some sweet deals and freebies.

Headlines, Skimm'd

No human (infrastructure) left behind. On Tuesday, Senate Dems announced a $3.5 trillion package they hope to pass via the reconciliation process (read: without GOP support) to bring back policies missing from the bipartisan infrastructure deal proposed last month. Think: "human infrastructure" initiatives around caregiving, education, and national paid family leave.

Trust issues for Big Tech. This week, France's Competition Authority fined Google close to $600 million for not paying news publishers before using their content. Stateside, Facebook followed in Amazon's footsteps and filed a motion to recuse FTC Chair Lina Khan from their antitrust lawsuits. They say the long-time critic of Big Tech can't be impartial.

Uncle Sam's not keeping the change. If you overpaid taxes on unemployment benefits, expect a refund soon. What else the IRS might be sending your way: the first expanded child tax credit payment. (Get As to your FAQs.)

News to Wallet

How Earnings Season Can Affect Your Money

Publicly traded companies are sharing their financial report cards. Because it's earnings season. And Americans are saying, 'show me the money.' A few of this season's star students so far: Delta Air Lines and PepsiCo, which crushed expectations now that more people are traveling and dining out. Big banks like JPMorgan and Goldman Sachs also did well. But not Bank of America, which lost revenue thanks to low interest rates and a drop in trading activity. Wondering how earnings seasons could impact your bottom line? We Skimm'd it for you.

Make Good (Money) Choices

If you've got that summertime sadness…

Try these products to fight annoying summer issues (hey, sweat, sunburns, and bug bites). Like a natural deodorant that actually works. And an anti-chafe balm that will have you saying 'bye-bye' to blisters and irritation. PS: they're all under $25.

If rising prices are eating away at your budget…

Bite back by investing. That's how your money could earn enough to beat inflation in the long run. Reminder: inflation is the general increase in the cost of everyday items. And why your dollars lose purchasing power over time. One way the gov measures it is with the Consumer Price Index, which tracks the average price of things like food, clothes, housing, etc. On Tuesday, the latest report showed it rose 5.4% since June 2020 – the fastest pace in 13 years. With used cars, gas, women's dresses, and baby clothes among the range of things that have gotten pricier. Meanwhile, annual stock market returns have averaged around 10% since 1926.

If you have a budding interest in investing...

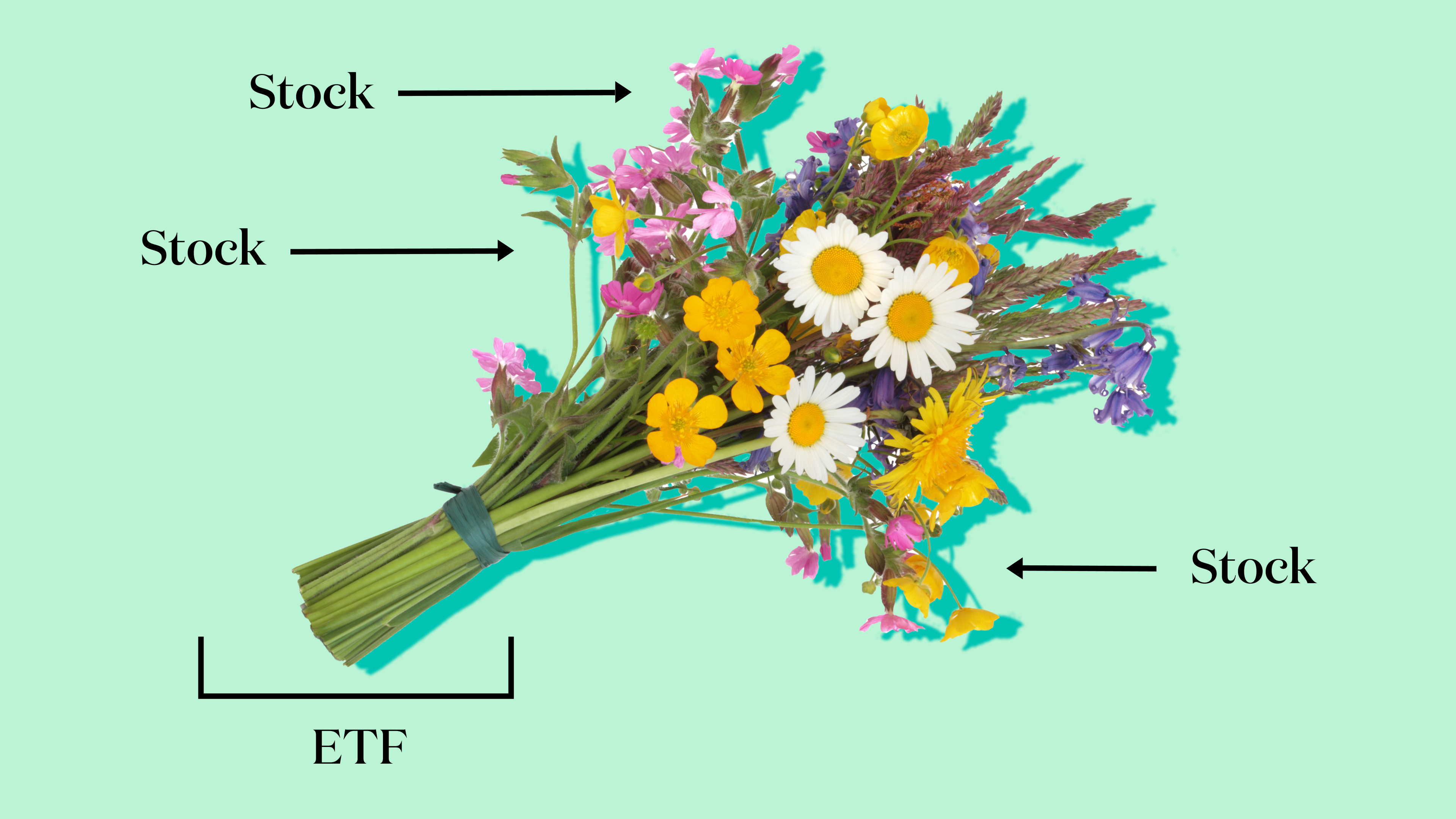

Meet exchange-traded funds. An ETF is a collection of assets (think: stocks, bonds, commodities) that are bundled together and sold as a single fund. Like with a bouquet of flowers, each pick can be lovely on its own. But mixing and matching a variety of blooms investments can make for a beautiful arrangement. And help create instant diversification (aka an investor's secret weapon against risk). Bonus: ETFs tend to offer low fees, helping make them fan favorites. Learn more about ETFs and how to make them part of your portfolio here.

Hot Off The Web

TikTok creators are banned from posting certain sponsored money content.

Staff at one Burger King said "we all quit," while McDonald's franchises sweeten employee benefits.

An 82-year-old woman is riding shotgun on both the Blue Origin and Virgin Galactic space flights. And an 18-year-old is now riding with the Bezos brothers.

Maine says, 'first,' and establishes a program to make companies, not taxpayers, cover recycling costs for their packaging.

Black Widow brought in $215 million opening weekend, a pandemic high and a win for its female-led cast and crew.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.