It’s been a long year week. The upside: The Dept. of Education will let you keep your tax refund — and other gov payments (like earned income and child tax credits) — if you have past-due student loans. Until November that is. (Reminder: The pandemic pause on student loan payments ends May 1.) As for the rest of the news…

Headlines, Skimm'd

Conflicts and commodities. Tensions at the Russia-Ukraine border continue to keep the world on edge. And the prices of some commodities (like oil) have already reacted to the threats of an invasion. (Hello, record gas prices.) The costs of grains (and your favorite pasta) could also spike if the conflict escalates. Not great news for your gas and grocery budgets.

Shop ‘til the prices drop. Consumers were spending again in January — especially online and on furniture and cars — with retail sales up 3.8% after falling in December. Inflation contributed to larger receipts last month. But some analysts say people are shopping more in general, too.

Trade roadblocks. The economic impact of the Freedom Convoy protests that brought blockades (the literal kind) to US-Canadian trade continues. Which is especially bad news for people shopping for a new car. Several major automakers have had to pause production due to protests. Potentially exacerbating already-high inflation on the price of new cars. And south of the border, the US suspended avocado imports from Mexico after a safety inspector received a threat amid cartel turf wars.

Let’s Talk About…

Where Your Tax Dollars Go

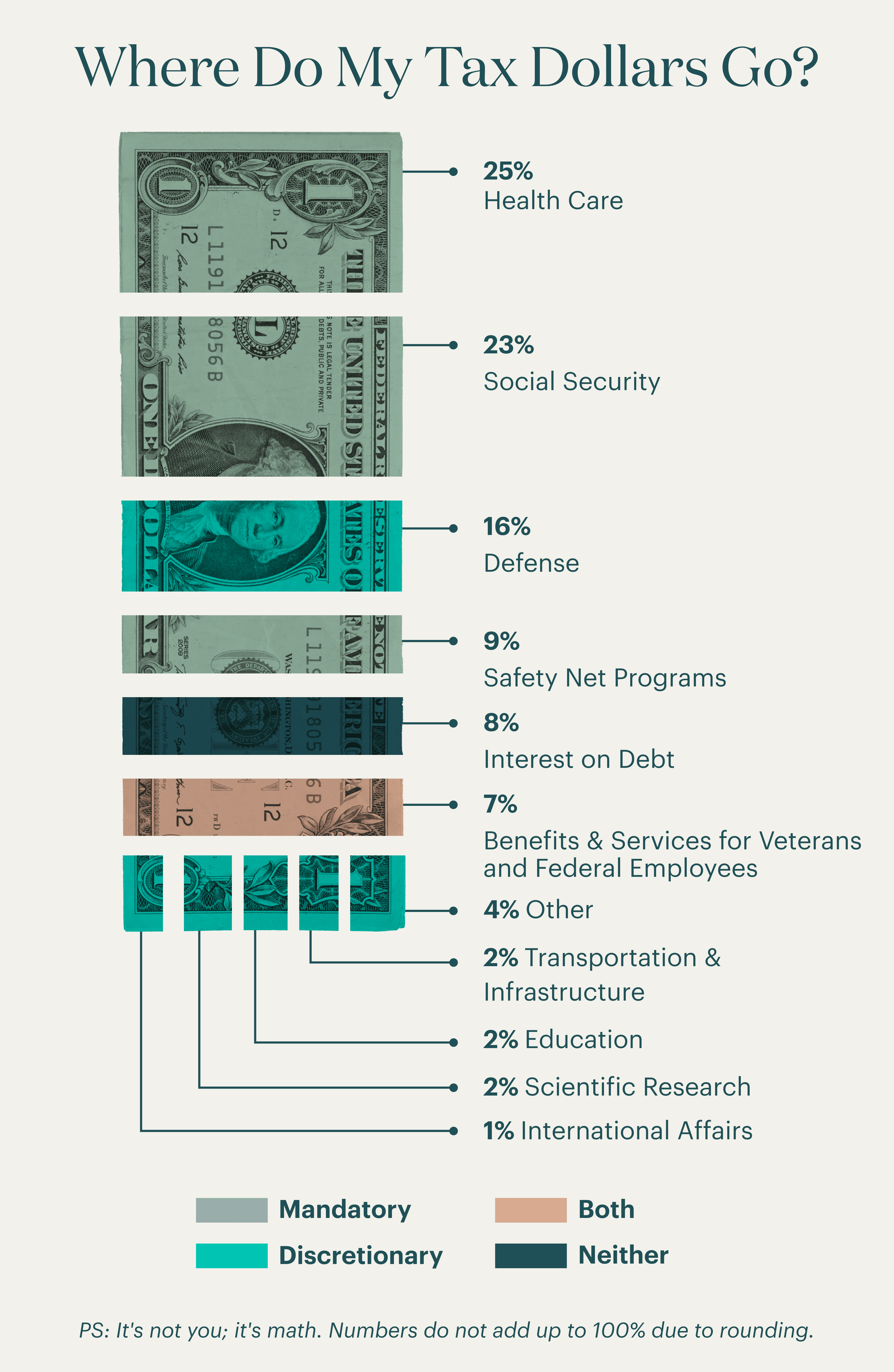

Ever done your taxes and wondered where all that money goes? Same. The short answer: Most of it goes toward funding gov operations (hi, Department of Defense). And public benefits like Social Security, Medicare, and safety net programs (think: unemployment insurance and SNAP benefits). The long answer: It’s complicated. Because the gov's budget isn't the same every year. We Skimm’d what you need to know about how your tax dollars are spent and why.

Make Good (Money) Choices

If impulse buys keep derailing your budget…

Strike a balance. The occasional splurge is fine. But constantly swiping beyond your budget can keep you from reaching your money goals. Like saving for a trip to Italy or investing for a 20% down payment on a home. For expert tips on how to keep your spending in check, we tapped a money pro who specializes in financial therapy. Her advice: Plan to treat yourself while still prioritizing your financial needs and long-term goals. And don’t be too hard on yourself for adding that candle to your cart on a whim. Skimm more ways to curb your impulse spending.

If you’re hoping for a higher savings account interest rate…

Don’t hold your breath. It’s true: The Fed is planning to raise interest rates soon. Also true: A higher federal funds rate usually = higher rates on deposit accounts and loans. But banks typically raise rates on variable-rate loans (like credit cards and home equity loans) first. And Americans stashed away so much cash during the pandemic that there’s no need to compete for your dollars. So don’t expect your savings to get a boost right away. Your move: Make sure you’re getting the best yield on your savings now by comparing your options. Think: community banks, credit unions, and online banks. And consider investing $$$ you don't expect to need in the next few years for bigger growth over time. (Hi, compounding returns.)

If your Insta feed is flooded with engagement announcements…

Save some cash while you save the dates. Because being a wedding guest isn't all free food and open bars. And a post-pandemic wedding boom could mean paying more for things like travel and lodging. Step 1: Set a budget for what you’re willing to spend on weddings this year. Step 2: Start putting some cash into a sinking fund each month to cover all the costs along the way (like gifts, plane tickets, and hotel rooms). Step 3: See more tips for surviving wedding season on a budget. PS: Congrats to everyone who got engaged this V-day. (Cheers, Simone Biles.)

Crypto, Decoded

Today's internet is where you buy, sell, and store cryptocurrency. Tomorrow's internet will be where you store crypto to buy and sell everything. And they call it Web3. The (alleged) next iteration of the internet is still a work in progress (relatable). But supporters say it will be a whole new world wide web that's owned and maintained by users. Read: not big tech companies like Google, Meta, or Twitter.

Some are worried that women are already being left out. And some are trying to make sure that doesn't happen. Like Serena Williams, Gwyneth Paltrow, and Mila Kunis. (And Skimm Money.) Getting in on the ground floor — especially if it disrupts the economy as much as proponents say — can mean making sure it's built as a level playing field. Which is why it’s important to get familiar with Web3 now. The main principles to know:

Decentralization: Web3 will be built on blockchain technology. So anyone can create content or communicate with other users without relying on a third-party platform to mediate. Bonus: fewer logins for you to remember.

Ownership: Taking out those corporate middlemen means creators own — and may even get paid — for their content. Think of it like earning a commission for every retweet you get instead of Twitter profiting from web traffic.

Black History Month: The Culture Carriers

To celebrate Black History Month, we interviewed female culture carriers who are championing Black culture. Trailblazers who are opening doors and creating representation in spaces that have notoriously lacked diversity. Up next: Dia Simms, the CEO of Lobos 1707 Tequila and Mezcal. We discussed inequity in her field, and the obstacles she’s faced in her career. Check out the full interview here. (Psst…after you click, scroll down to see her fave books and Black-owned nonprofits.)

Hot Off the Web

The Senate hit ‘snooze’ on a(nother) potential government shutdown, voting to fund operations until March 11 — the new deadline for a long-term budget.

Wealthy out-of-towners are beating out locals in this still-hot housing market.

Elon Musk donated nearly $6 billion in Tesla stock last year. To whom? No one knows.

Your next Netflix binge could be a docuseries on the accused crypto-conspiracy rapper, Razzlekhan, and her husband.

Busch Light to female NASCAR drivers: 'Get outta my dreams, get into my car.'

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.