Tax Reform

The Story

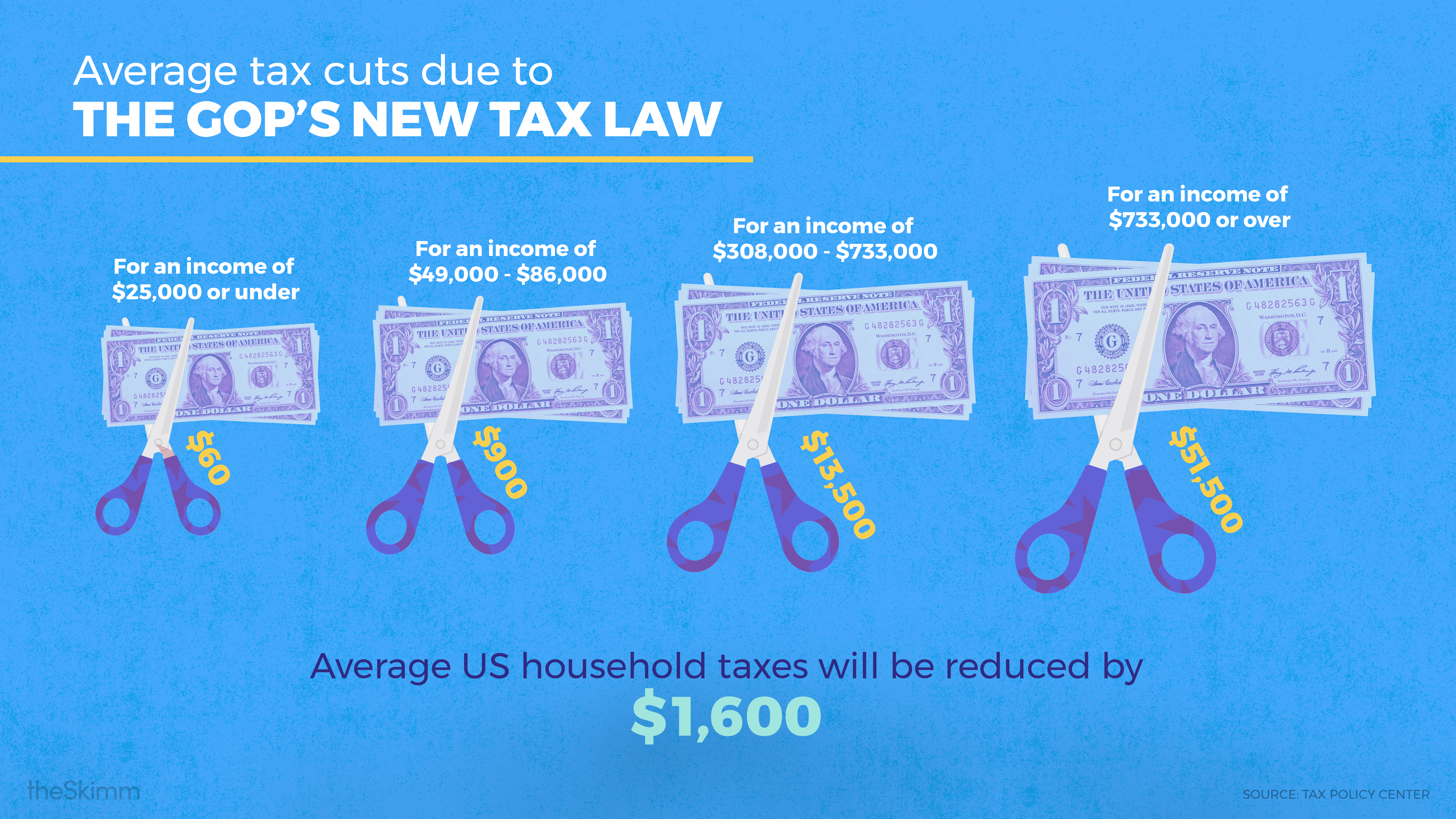

The GOP’s new tax law has a direct impact on your wallet. This year, you've probably seen a bump in your paycheck. Next year, you might see it in your tax return.

What’s the issue?

Last year, Republicans passed the biggest revamp of the tax system in decades. It’s a $1.5 trillion tax cut that slashes the corporate tax rate, and temporarily trims a lot of individual tax rates until 2025. Meaning, almost all taxpayers will see a break right now. But a lot of the tax cuts expire in a few years for middle and lower-income earners. In some cases, there are also some changes to how much you can deduct from your tax bill.

What’s the right say?

You’re welcome. These changes will bring businesses back to the US and put more money in people's pockets. American companies are rewarding their employees with a little extra cash thanks to their lower corporate tax. All things that make the US economy more competitive.

What’s the left say?

This will only hurt taxpayers in the long run. This is a horrible idea and irresponsible: the tax law is projected to increase the national debt by $1.9 trillion between 2018 and 2028. So we'll see you in the midterms.

What can my elected reps do?

— Your

state’s lawmakers

could decide to sue over the new tax law. But, unclear if that will do anything

—

Your

House reps

will have a say on what’s next for the tax law. If Dems win back control of the House in November, they've promised to undo parts of the GOP’s tax law. If this law stays in effect, the corporate cuts are permanent, while the individual changes expire at the end of 2025

theSkimm

This is one of Trump’s biggest achievements from his first year in office. Plan on lawmakers taking a side: 'this is the best thing that's ever happened,' 'the worst,’ or silence.

Live Smarter

Sign up for the Daily Skimm email newsletter. Delivered to your inbox every morning and prepares you for your day in minutes.

Read Next

Here’s What We’re Stocking Our Cabinets With Before Cold & Allergy Season

Dealing With Itchiness, Fatigue, Joint Pain, Jaundice, and Dry Eyes? Here’s How To Talk To Your Doctor About PBC

What Everyone Needs To Know About Metastatic Breast Cancer

Ask an Expert: How Do You Know If Your Dry, Itchy Skin Is Actually Something More Serious?

Women of All Ages Are Putting Their Health Last. Let’s Change That.

I Can't Remember the Last Time I Had a Checkup

Trending

© 2012-2025 Everyday Health, Inc., a Ziff Davis company. All rights reserved. theSkimm is among the federally registered trademarks of Everyday Health, Inc., and may not be used by third parties without explicit permission

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.