This Sunday marks the first day of Asian American and Pacific Islander Heritage Month. Which honors the culture and contributions of AAPI people in the US. While also acknowledging the challenges facing the community. And speaking of, May 3 is Equal Pay Day for AAPI women.Meaning the average AAPI-identifying woman would have had to work all of last year and through next Tuesday to catch up to a white man’s earnings from last year. But as we close out April (and the pay gap)…

Headlines, Skimm'd

Stocks, slump’d. The S&P 500 is on track for its worst month since March 2020. And the Nasdaq had its biggest one-month decline since October 2008. What’s going down? A few things. COVID-19 lockdowns in China are slowing economic activity (more on that later). The Russia-Ukraine war continues to bring uncertainty and disruptions to the global economy. And the Fed may raise interest rates (again) at their meeting next week. One glimmer of hope for the market: a few good earnings reports. (Hi, Microsoft and Visa.)

GDP stands for ‘going down, presently.’ At least it could. Because the Bureau of Economic Analysis reported the US GDP (hint: it measures the value of goods and services produced) shrunk 1.4% in the first quarter of 2022. Its first drop in two years.For similar reasons the stock market is struggling (the pandemic, the war, and inflation). Consumer spending is still strong,but the country still has some recovering to do to get production up to speed.Don’t throw around the ‘r’ word (aka recession) just yet.

Accepted > indebted. May 1 is college decision day. The deadline for many students to commit to a college. And maybe student loans. Some of which President Joe Biden might be thinking about forgiving.A promise he left cold on the campaign trail but is warming up to again (just in time for midterms). Yesterday, the president said he’ll have an answer on any forgiveness plan in the coming weeks. Just not the $50,000 some were hoping for.

Better together? This week, another Staten Island Amazon warehouse is voting on whether or not to unionize like its neighbor across the street. But it’s not just Amazon workers. (We see you, Starbucks, Apple, and Condé Nast employees.) One reason for the recent rise in organized labor? The pandemic is shining a light on the need for better wages. Supporters say unions could help boost pay and the economy. And according to a report by the Economic Policy Institute, could help close gender and racial wage gaps.

News to Wallet

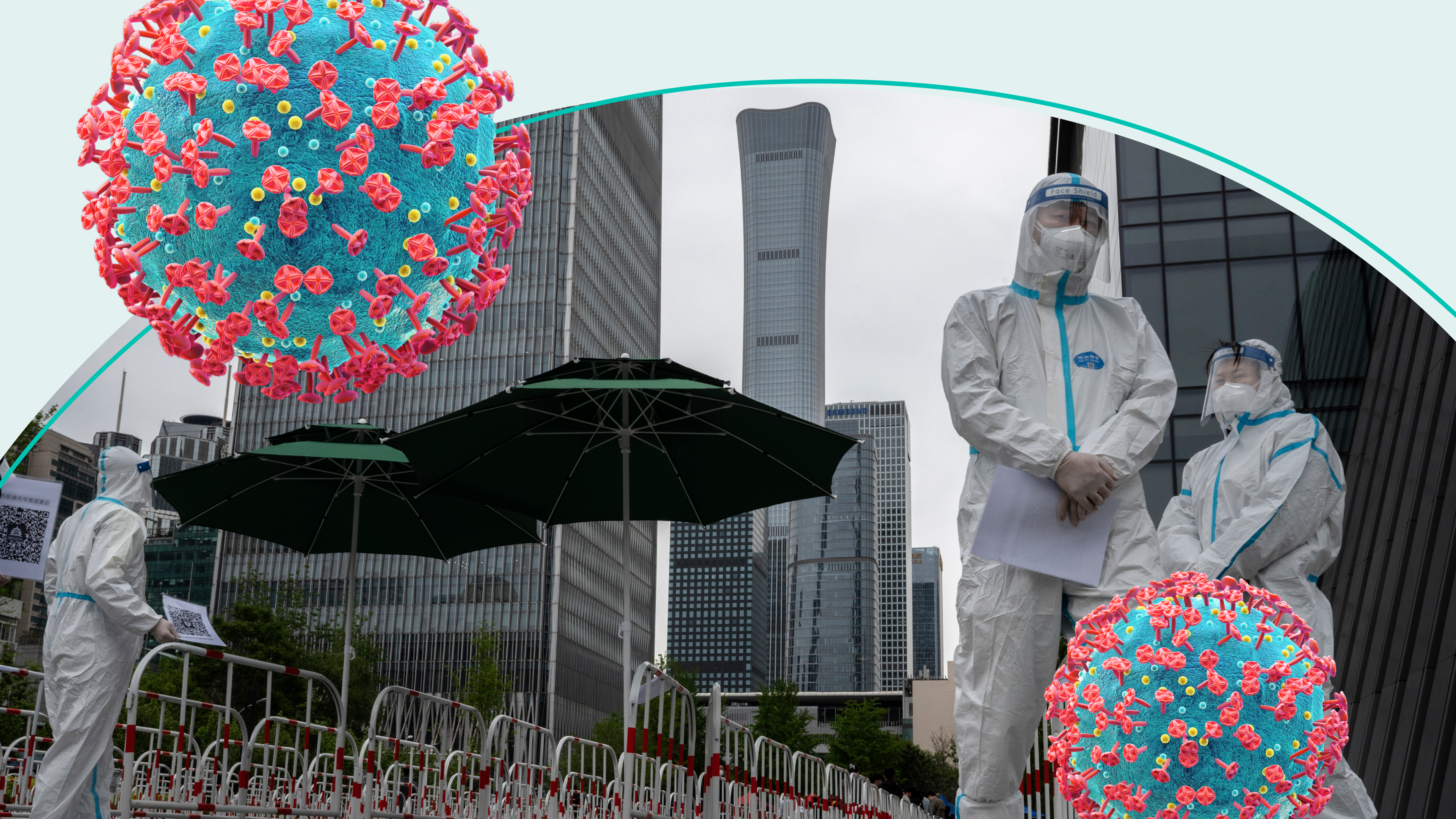

ICYMI, Shanghai, China’s biggest city, has been on lockdown since late March. Because the country is attempting to eliminate COVID-19 with what some are calling a “zero-covid” policy. And the shutdown could have worldwide economic impacts. Including the US economy (read: your money). Because Shanghai is home to the world’s busiest port and manufacturing plants that are key for big businesses. Think: Tesla, Volkswagen, and Apple. Here’s theSkimm on what you need to know. (Hint: Prepare for even higher prices and more empty shelves for things like electronics.)

Make Good (Money) Choices

Financial Literacy Month, aka April, is dedicated to promoting financial education. And so is Skimm Money. Because the first step to building wealth and achieving financial independence is understanding how money works. That's why, this whole month, we’re talking about money rules you may have heard from the experts (or your parents)...and explaining why some rules were made to be broken.

Money rule: Don’t talk about your salary.

Why you can break it: It's not Bruno. Being open about how much you make — and getting others to share their salary with you, too — can help you get paid what you want (and deserve). And narrow pay gaps that keep women from earning more. Warning: It can be uncomfortable to talk about your salary since money is still considered a taboo topic. But it can help everyone involved make sure they’re being paid fairly. Here’s who you should invite to a salary chat. (Plus, tips for how to start the conversation.)

Crypto, Decoded

New kid on the blockchain? Crypto credit cards. Gemini (hint: a crypto exchange) recently launched a crypto-earning credit card that racks up coins the same way you’d earn airline miles or cashback with other cards. And Gemini isn’t the only company offering this type of card (hi, Venmo and Robinhood). But should you consider one? Here are a few factors to consider to help you decide:

How is the crypto bought? Some cards, like the Gemini card, automatically buy some crypto when you swipe. So there’s no waiting to redeem when prices are low (and they swing often).

What are the benefits and fees? Crypto rewards are one perk. But consider if the card offers other benefits (think: welcome bonus or a 0% APR offer). Also, see if there are fees to redeem the crypto (or other extra costs).

Can you pay it in full each month? Because the value of any crypto you earn may not outweigh the interest you’d pay on carrying a balance.

Do you need flexibility? If so, a regular rewards card — and using your cashback to buy crypto — might be the way to go.

Blue Check Special

Instead of “taking to Twitter,” the world’s richest man (aka Elon Musk) is just taking Twitter. The billionaire — who happens to have over 88 million Twitter followers — made a $44 billion bid to buy the social media platform.And though Twitter’s board approved the deal, it won’t be finalized until shareholders vote on it. But it’s already making waves and moving markets. (Just like many of Musk’s tweets.) What's next? The future of Twitter could hinge on changes he makes to the social media site beyond just an edit button.

Hot Off the Web

The Senate voted to confirm Lael Brainard as vice chair of the Fed.

Harvard University committed $100 million to study and redress its ties to slavery.

Thieves threw the Bored Ape Yacht Club ‘overboard,’ hacking the collective’s Instagram account to steal over $1 million in NFTs.

A tiny (like smaller than a deck of cards tiny) book of poems written by a young Charlotte Brontë sold for $1.25 million.

Taking flight soon: Free Wi-Fi on Hawaiian Airlines (powered by SpaceX’s Starlink) and better pay for Delta Airlines flight attendants.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.