The Story

Your W-4 is how you tell your employer how much of your paycheck to set aside for the gov. That impacts what amount you bring home and what you’ll owe (or get back) when you do your taxes.

Sooo you better get it right?

Right. You usually fill out a W-4 when you start a new job. But you can update it whenever you want. Like if you got a big refund last year, and you’d rather keep more of your money throughout the year instead of letting Uncle Sam borrow it. Or if something big happened – you bought a house, had a kid, got married, started a biz, etc. – that could affect how much you owe in taxes.

Sounds complicated.

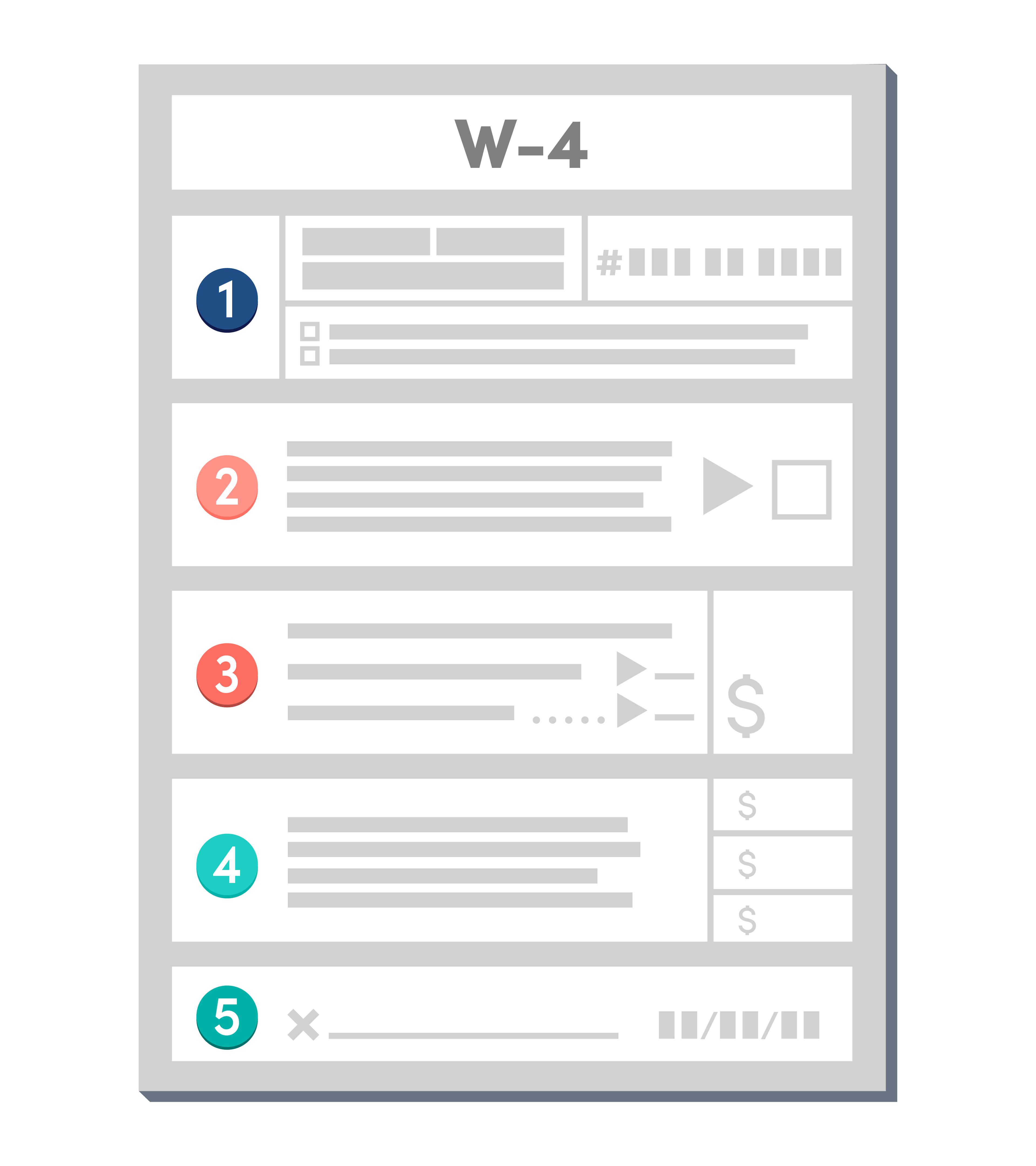

The W-4 got a makeover for 2020, making it a lot easier to navigate. You may even get to skip a few steps. We’ll break it down.

Step 1: Share some basic info and your filing status.

Your name, address, Social Security number – stuff you know. If you get to the “filing status” part and need some help, try this tool.

Quick refresher: “head of household” is for single people with dependents. If you’re married, filing jointly could help you qualify for a lower tax bracket, higher standard deduction, and maybe more credits and deductions. But you might consider keeping things separate if:

You’re going through a divorce or separation.

You make about the same amount.

One person makes less, and you could owe less by itemizing deductions (vs. taking the standard deduction).

One person makes less and is on an income-based federal student loan repayment plan.

You have assets (or liabilities) you’d rather keep to yourselves.

Run the numbers both ways to see what saves you more money. The chart on page four of your W-4 can help. So can a professional, if that’s your style.

Step 2: Account for multiple streams of income.

If you’re filing solo and have one job, you can skip this section. If you’ve got more than one job or you’re filing jointly and your partner works, you’ve got three options to fill out this section:

Grab recent paystubs and hit up the Withholding Estimator.

Fill out the Multiple Jobs Worksheet on page three, then add your number to Step 4(c).

Check the box at Step 2(c) if both of your jobs (or you and your spouse’s jobs) pay about the same.

Psst...your withholding (how much your employer withholds for income taxes) will be most accurate if you fill out Steps 3-4(b) based on your highest-paying job.

Step 3: Claim dependents.

Multiply the number of qualifying children under 17 by $2,000. Then multiply the number of other dependents (like a retired parent that lives with you) by $500. Add them up, and you’re done with this step.

Step 4: Make a few other adjustments.

This is where you mention any other money you get that isn’t taxed upfront. That could be investment dividends or retirement account withdrawals, side hustle earnings, etc. Estimate the total in Step 4(a).

In Step 4(b), let the IRS know if you think you’ll claim deductions besides the standard one. Some popular deductions: medical expenses, mortgage interest, property taxes, charitable donations, and student loan interest. The worksheet at the bottom of page three will walk you through it.

If you want extra money withheld from your paycheck, fill out Step 4(c). See Publication 505 (pages 16-19) if you aren’t sure.

Step 5: Give your sign-off.

Read it over, then make it official.

theSkimm

Learning how to fill out a W-4 can help you avoid mistakes. And a surprise tax bill. Please, and thank you.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.