Since 2009, the national minimum wage has been $7.25 an hour (or about $15,000 a year, before taxes, assuming 40-hour workweeks...and no weeks off). Read: not enough to cover basic bills, even in states with the lowest living costs. And with inflation running high in 2022, it’s now worth even less than it was before. Hint: it’s at its lowest value in 66 years.

Raising the minimum wage has consequences beyond workers hoping for a bigger paycheck. Here’s how it could affect your wallet.

If you're thinking about your budget...

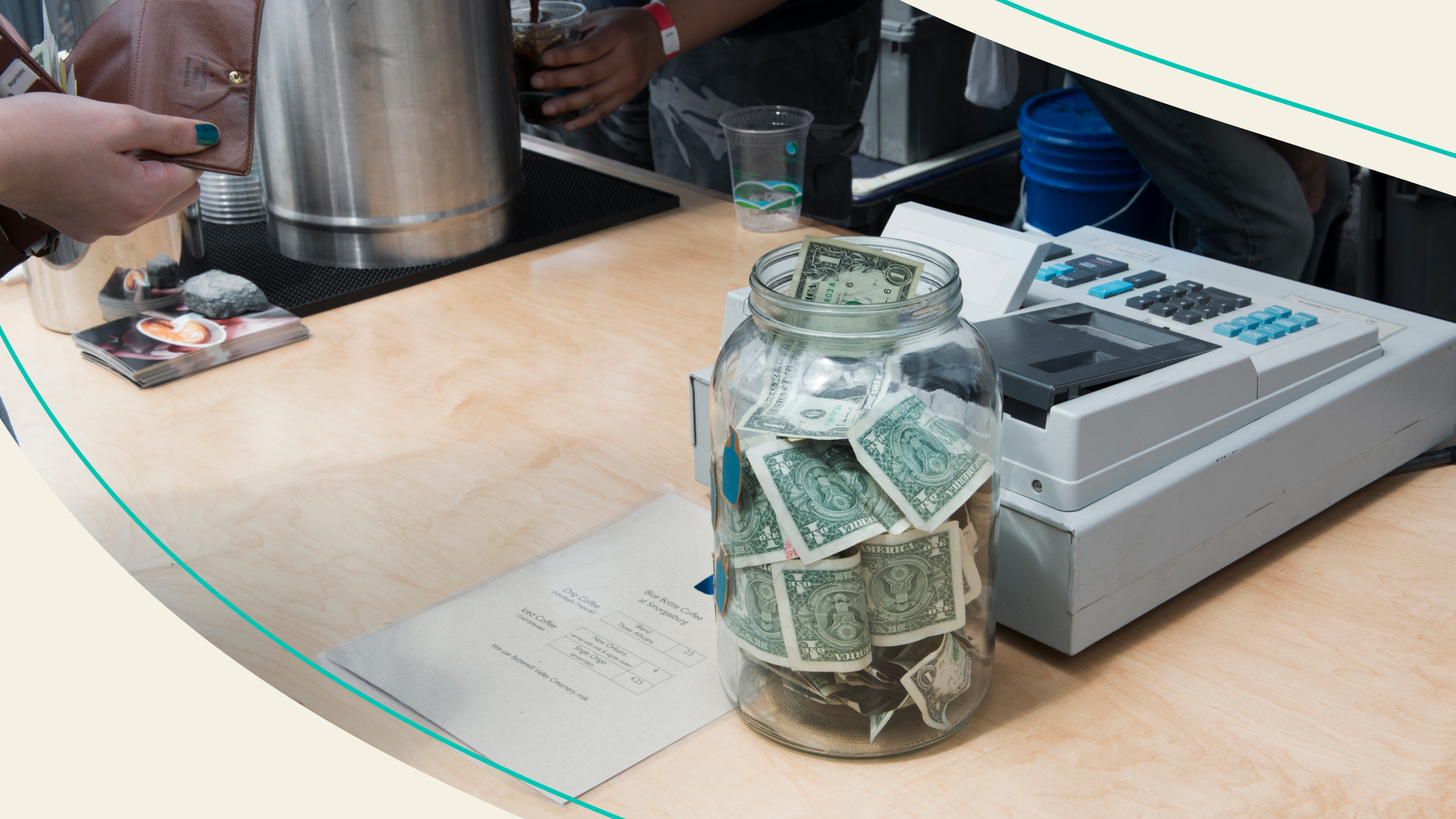

Plan to spend more on everyday purchases. Maybe. Businesses with a lot of minimum-wage workers — think: restaurants and retailers — will have to adjust to paying employees more. And may look for that money to come from somewhere besides their cash registers. Such as your wallet.

If you're in the market for a new job…

Prep for more competition. When the minimum wage goes up, some research has pointed to less job-hopping and older people working longer. Pro tips: stand out from the hiring pool by always having an updated resume, networking virtually or IRL with pros in your field, and keeping your skills sharp (or learning some new ones).

If you're wondering how this affects the economy...

It could get a boost. Depending on who you ask. Fans of a higher minimum wage point out that a chunk of the workforce earning more = more disposable income to boost consumer spending, a major driver of economic growth.

Or it could suffer more job losses. Critics of raising the minimum wage too high or too fast say higher prices won’t be enough to offset lower profits for small businesses. Meaning you could see your fav local cafe, brewery or boutique struggle to stay afloat. Or resort to cutting jobs.

theSkimm

Some say raising the minimum wage is a great move for workers and the economy overall. Others say ‘eh, it's complicated.' While it may not be raised anytime soon, give your savings account and resume a little extra attention.

Updated July 20 to include recent inflation info.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.