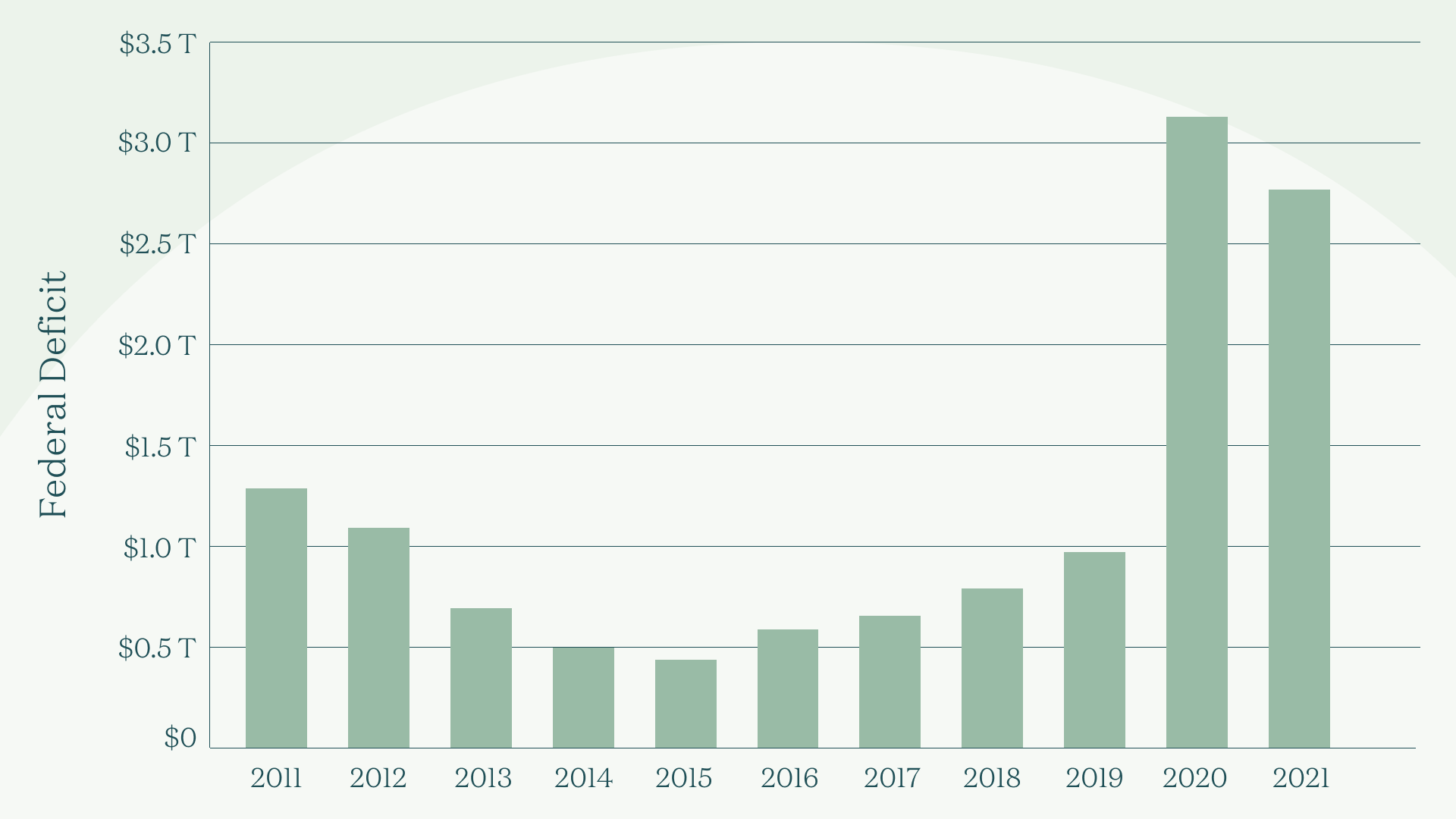

The pandemic hit Uncle Sam’s budget hard. In 2020, COVID-19 relief efforts (think: stimulus checks, small biz loans, and extra unemployment payments) helped push the federal budget deficit (the difference between what it spends vs. brings in) to a record high. This year, the (bumpy) recovery and more tax revenue collected helped bring it down to *wait for it* the second-highest level at $2.8 trillion. That's one reason some lawmakers are against more big gov spending (hey, Build Back Better bill).

The deets that matter for your wallet: When the gov's budget is out of whack, it has to figure out a way to balance it. Uncle Sam's got the same two options we all do. One is to spend less, which could mean making changes to programs like Social Security, which is already struggling.

The other is to bring in more money. That could be done by raising taxes or issuing new bonds. Treasuries are usually considered one of the safest investments because they're issued by the US gov, so their yields (what you earn from a bond) are relatively low. But when the gov's finances are rocky, investors get trust issues that the gov can afford to pay them back. Meaning Uncle Sam will likely increase the yield on new bonds to attract investors and compensate for the extra risk. The ripple effect: the treasury yield influences rates for other types of loans, like fixed mortgages. So a higher rate on gov bonds can drive up what you pay to take on new debt.

Your move: You can’t put the gov on a budget, but you can mind yours.

Rev up your retirement contributions. Uncertainty around Social Security means it's even more important to make sure you’re looking out for Retired You. Step one: figure out how much money you'll need. Then start investing.

Take care of your tax bill. Aka look up all the deductions and credits available to you, and claim them – a good idea whether the federal deficit is high or not. Friendly reminder: certain retirement account contributions can lower your taxable income. Win-win.

Get strategic about new debt. Higher mortgage rates mean you could pay more to add "homeowner" to your resume. Building up a bigger down payment can lower what you owe. Making sure your credit score is in good shape helps, too.

theSkimm

You might not be able to control what Uncle Sam does with his money. But you can be smarter about yours. That could mean giving your savings some love, adding to your retirement account, minding your tax bill or just staying on top of news that can affect your financial future.

Updated Dec. 20 to include the latest gov spending news.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.