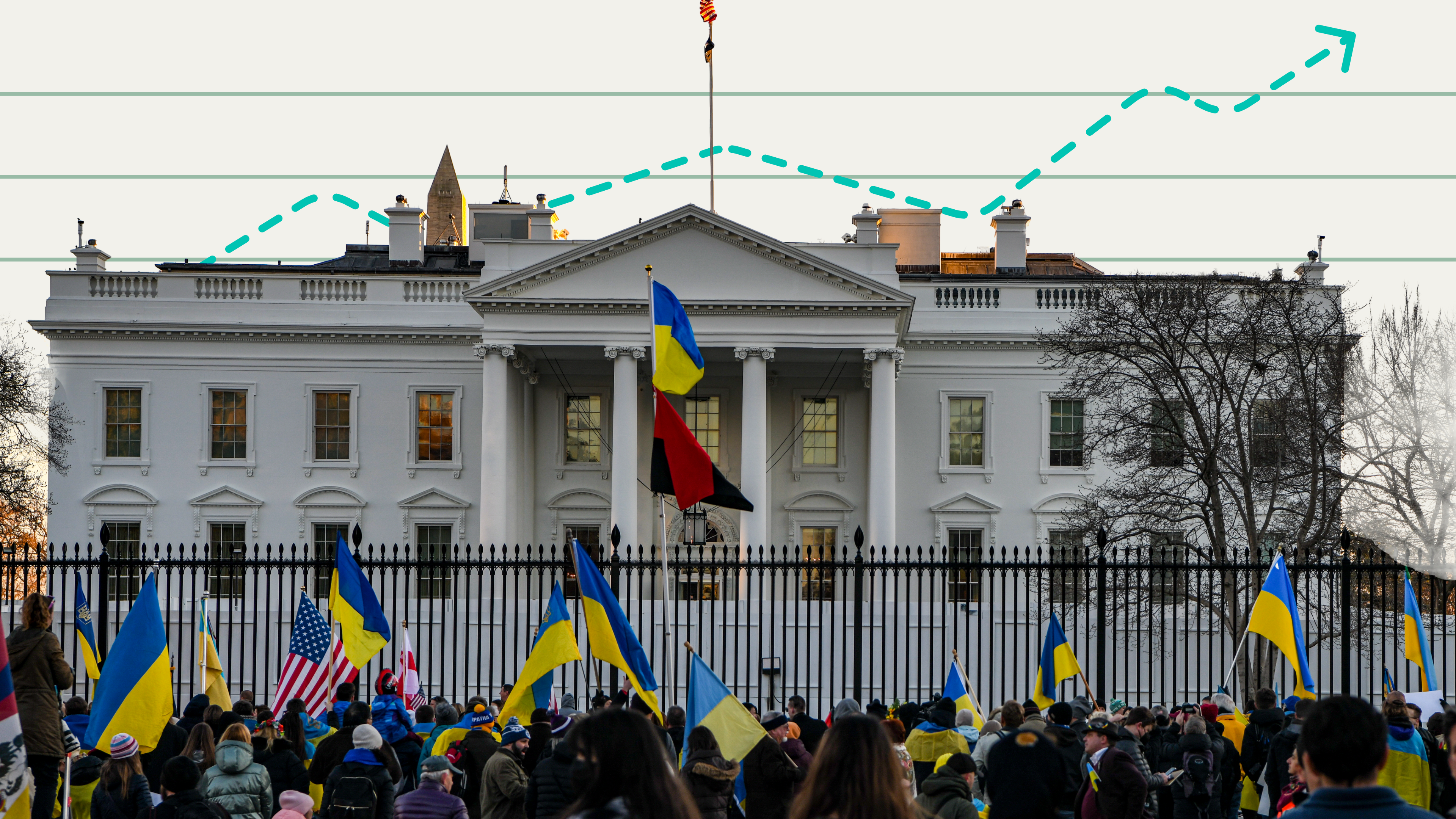

Russia’s invasion of Ukraine has sparked political, humanitarian, and economic crises across the world. And the economic fallout is already being felt in the US. Particularly at the gas pump and in the stock market. As the conflict continues, the US is bracing for disrupted supply chains and limited resources (think: wheat, oil, and natural gas), which could drive already-high inflation even higher. Here’s theSkimm on what that means for your wallet.

What you need to know: When Russian troops entered Ukraine, President Biden announced intensifying sanctionsaimed atdisrupting Russia’s economy and Russian President Vladimir Putin's war efforts. Including blocking select Russian banks from processing transactions in dollars and preventing Russian corporations from raising money in US markets. And banning Russian banks from SWIFT, aka the Society for Worldwide Interbank Financial Telecommunication.

Then, amid accusations of war crimes in early April, the US announced another round of sanctions on Russia. Including against Putin’s two adult daughters and the country’s largest financial institutions. US lawmakers also voted to revoke Russia’s “most favored nation” trade status and ban imports of oil and other energy products.

Biden has said that these sanctions are designed to “maximize the long-term impact on Russia and to minimize the impact on the US and our allies.” But he’s also made it clear that standing up for freedom will come with a price as the conflict continues and the sanctions against Russia start having their intended effects— and start impacting global supply chains and causing resource shortages in the process.

How much will the Russian invasion cost the US economy? It depends, largely on how long the conflict continues and the broader effects that it has on the global economy.

Your move: There's no telling for sure what will happen. But you can take some steps to lessen the impact this geopolitical conflict could have on your money and, if you’re able, put some of your dollars toward helping others.

Stay the course with your investments. Your 401(k) or other investments might fluctuate. Upon news of the invasion, US stocks dropped — even entering correction territory (hint: that’s a drop of 10% or more in a single day). Only to rebound and close higher than before Russia’s attacks on Ukraine began. Big swings are likely to continue as the crisis unfolds. The best course of action? Staying invested for the long haul and allowing your balance to build over time.

Drive less, spend less. Russia is a big player in the world oil game, and sanctions imposed on Russia leave the world (including the US) scrambling to source oil from elsewhere. Cue: higher costs at the pump. Using apps like GasBuddy and Gas Guru to compare prices, and driving less (when possible) could help keep your budget in check.

Use less energy. Not only is Russia a supplier of oil, but the country also exports large amounts of natural gas, which is used for everything from cooking to heating homes. Without Russia’s supply, the price of natural gas could go up, especially as Europe searches for alternative sources. Which could increase costs across the world.Turning your thermostat down a few degrees could help you use less natural gas, and keep your bill from going up.

Look for ways to save at the grocery store. The US doesn’t import a lot of food directly from Ukraine or Russia, which together produce nearly a quarter of the world’s wheat. But Europe does. As Europe seeks alternative sources, the whole world could feel the pinch, driving up prices on wheat-based items. (Think: bread and pasta.) Russia is also a large producer of fertilizer,and disruptions to this supply chain could make it more expensive or difficult to produce food. Checking in on your grocery budget, buying in bulk, and comparison shopping could help you beat rising price tags.

Inflation-proof your budget. Disrupted supply chains and resource shortages are among the factors that could contribute to making the US’s already high inflation worse. And with oil and energy costs going up, it could get more expensive to buy things overall. Enter: Rising shipping costs, which could be passed along to you (the consumer) in the form of higher prices at checkout. See our tips on how to cope with higher prices, and start to adjust your budget now to avoid surprises later.

Help refugees and people on the ground. Consider paying it forward if your financial situation allows. Organizations have been set up to help Ukrainian refugees, and we Skimm’d ways to contribute here.

theSkimm

Russia’s invasion of Ukraine has already hit the world’s interconnected economy. And you might feel it in your wallet with higher prices at the pump, grocery store, and in your energy bills. It's a relatively small price to pay, considering Ukrainians are sacrificing everything to flee to safety or stay to fight for freedom. But you can minimize the effects of the conflict on your own money even more by making a few moves to protect your budget and portfolio.

Updated April 8 to add additional sanctions imposed on Russia.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.