Hey hey.

This week, the internet finally broke. But the finance world kept spinning on. Here are the top money stories and tips you need to know.

Headlines, Skimm’d

The price is wrong. From May 2020–May 2021, an index that measures the average price of things like food, clothes, and housing rose 5% – the fastest jump since 2008. (Worse? That doesn't count Chipotle’s price hike.) Here's what to do with your money when inflation picks up.

Both sides of the (bit)coin. El Salvador became the first country to adopt Bitcoin as legal tender. Not legal: crypto scams. They cost US consumers $52.6 million in the first quarter of this year, up 80% from the last quarter of 2020.

Too legit not to quit. Job openings in April hit a new record of 9.3 million. And so did the number of people who quit their jobs (almost 4 million). Experts say that's a sign workers are confident they can find a better job quickly. Note to employers hoping to retain talent: show them the money and benefits.

News to Wallet

What Higher Corporate Taxes Mean for Your Wallet

Last weekend, the G7 countries (seven of the world’s largest economies) agreed to back a global minimum tax rate of at least 15%. If it goes into effect, that’d mean big corporations could no longer shift profits overseas to save on taxes. Fans say a global minimum tax could generate more revenue for high-tax countries like the US. Here’s how businesses paying more taxes could also impact your bottom line.

Make Good (Money) Choices

If you love extra credit…

Get ready to (re)start repaying your student debt. Reminder: the gov's had federal loans on pause for a while. Because pandemic. But the plan is to hit "play" on October 1. So think about how you'll adjust your budget to make room for the bill or if you need to try to lower it. Pro tip: if you're currently on the standard repayment plan, see if you qualify for one that bases monthly payments on your income. You can also consider refinancing. Crunch the numbers to make sure this would save you money. And heads up: you have to use a private lender.

If you’re growing your fam (or want to later)...

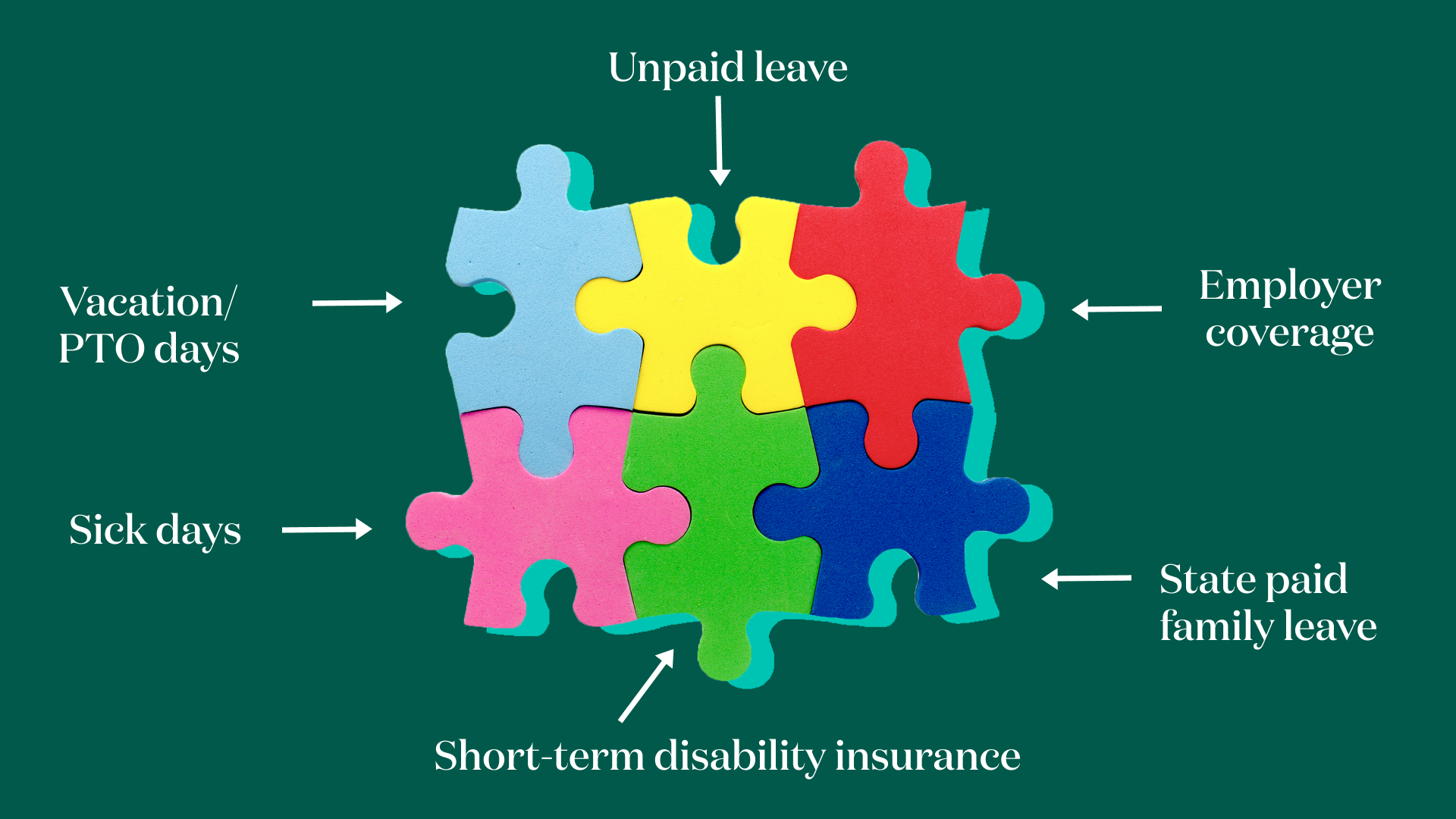

Think about how you'll prep your finances to go OOO. Because the US is the only industrialized country without a national paid leave policy – even though (no surprise here) it’s a very popular idea among Americans. President Joe Biden's American Families Plan proposes up to 12 weeks of paid leave for qualifying workers. TBD if it becomes reality. In the meantime, find out if your employer or state offers some paid time off. You may also be able to piece together other options for mat leave. We Skimm'd more about what you need to know about getting your money ready to afford the necessary time off.

If you’re shopping for Dad…

Check out these gifts under $50 for every kind of father figure in your life. From lightweight Birkenstocks to a BBQ seasoning set to a Dad joke game. And if you’re planning a sibling group gift for Father’s Day, here are a few bigger-ticket items, too. Shopping...check. One less thing on your to-do list is worth celebrating.

Thing to Know

Infrastructure: the basic building blocks needed for a society and its economy to thrive. That can include physical infrastructure (roads, bridges, and highways) and social infrastructure (affordable childcare, paid family leave, and other policies that make it easier to work and provide for families).

In March, Biden proposed a $2.3 trillion package that targeted both. In May, Republican lawmakers countered with a scaled-down version that focused primarily on physical infrastructure. Negotiations are stalled for now. Next steps: Biden's talking with a bipartisan group working on its own plan.

One Thing You’ve Been Putting Off

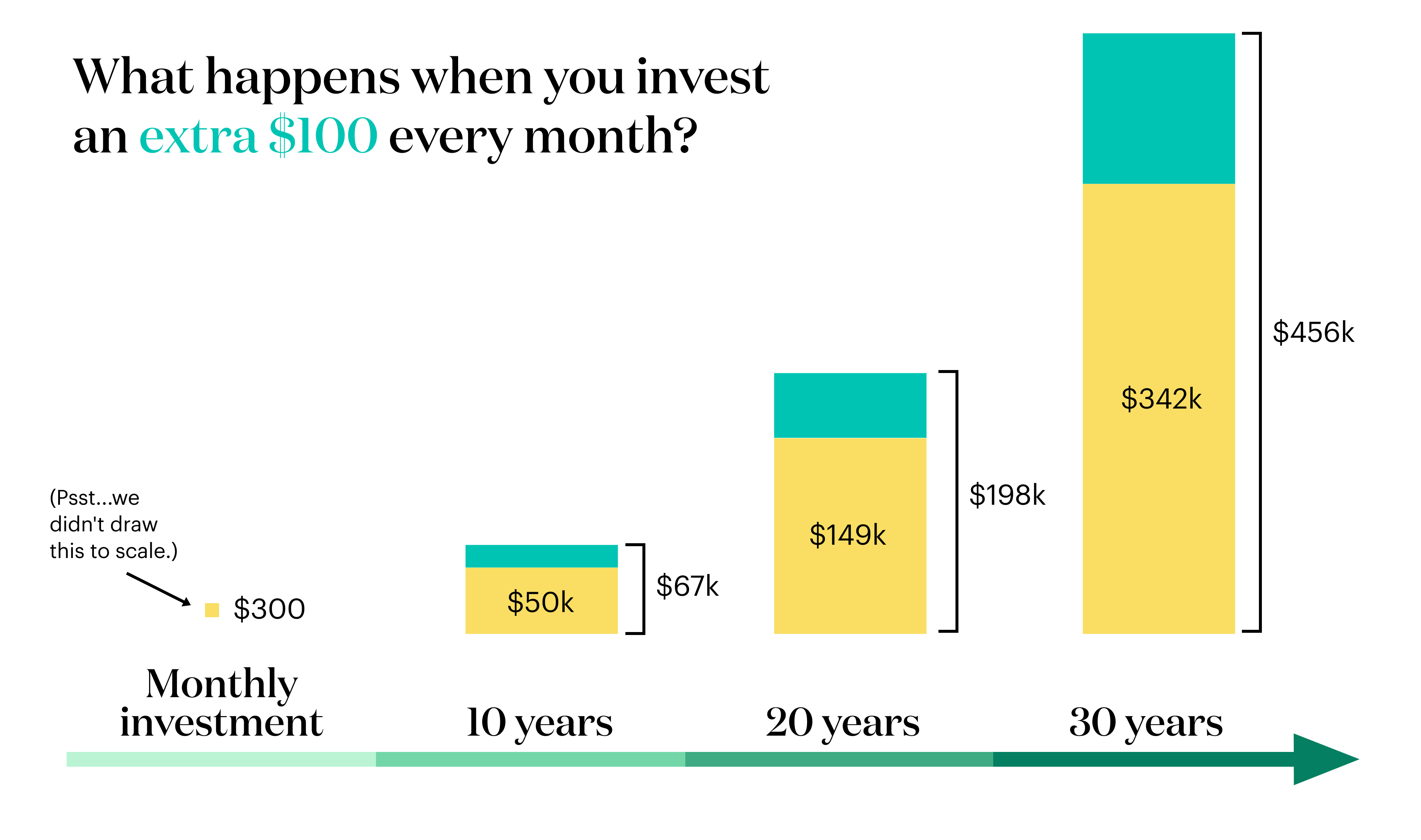

Increasing your retirement contributions. But hopping on investing a little more now could mean a big payoff later. Example: say you're currently investing $300 a month and getting a 7% annual rate of return. After 10 years, you’d have about $50,000. Not bad. But boosting your contribution to $400 each month would get you about $17,000 more. After 30 years, investing $400 instead of $300 per month would get you roughly $114,000 more in your account. And a big thanks from Future You.

Hot Off the Web

Systemic racism holding Black women back has cost the US economy billions.

The Keystone XL pipeline project fell apart.

Meme stocks of the week: Clover Health and Wendy's.

Jeff Bezos is taking a post-pandemic vacay to space. For $4.8 million, you can ride shotgun.

Carbon dioxide in the atmosphere hit its highest level in 4 million years.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.